The problem with part-time financial advisory is the difficulty of making money. Part-time financial advisors have to prove that they are trustworthy. This is where the compensation package comes into play. The perk of working for a variety clients should be considered.

Qualifications

If you're considering a career as a part-time financial advisor, the qualifications you need to get started are varied and may include a college degree, insurance license, or other professional designations. Clients and employers will see that you are highly educated and have a strong work ethic.

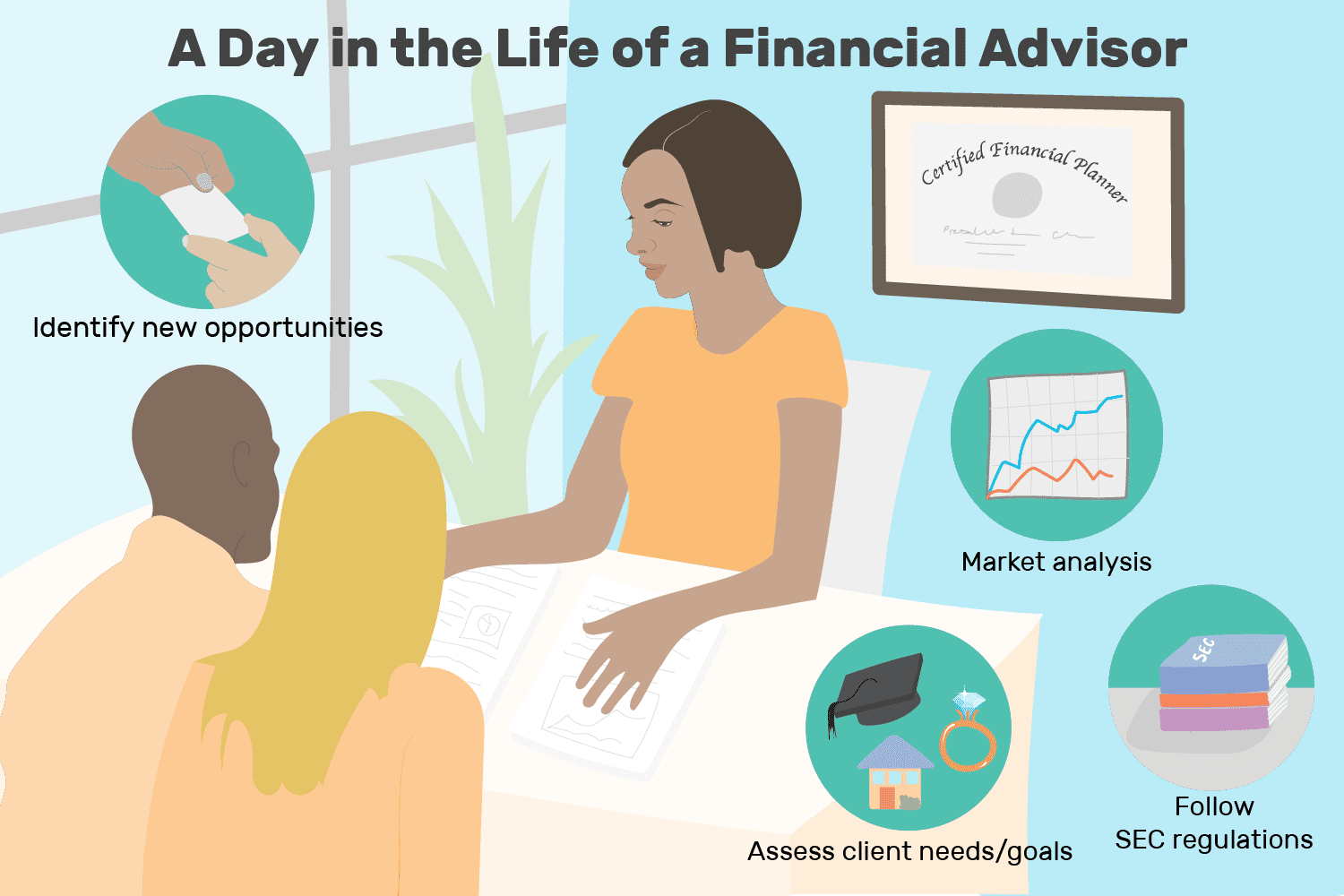

Financial advisors must be analytical and have a thorough understanding of financial markets. Financial advisors must be proficient at tracking data and analyzing the pros/cons of different strategies. They also need to communicate their findings to their clients. They should have great communication skills as they are often required to deal with many clients and explain complex financial terms clearly.

Compensation

Part-time Financial Advisors are paid more than the national median. However, their income can vary widely depending on the location. Atkinson (NE) is the most highly paid city for part time financial advisors. New York City, NY, and Bridgehampton NY are two other cities that pay well to financial advisors. These cities have an average income of $10,867 and $13,942 respectively which is higher than the national average for financial advisors.

Commissions pay out at 9-10% and increase every 12-18 months. Advisors may also earn more through other avenues than commissions. Advisors can also receive compensation for the sale of assets.

A wide variety of clients are served

As a financial advisor, you will be responsible for advising clients on wealth management strategies, balancing administrative tasks, follow-ups with customers, and referral activities. You must have patience and great communication skills. The goal is to build a client base and establish a strong book of business.

A financial advisor might have several clients, or they could specialize in one. You can focus your marketing efforts and increase your effectiveness by choosing a niche. Typically, financial advisors choose a niche because they are passionate about it.

FAQ

What is retirement planning?

Retirement planning is an essential part of financial planning. It helps you prepare for the future by creating a plan that allows you to live comfortably during retirement.

Retirement planning includes looking at various options such as saving money for retirement and investing in stocks or bonds. You can also use life insurance to help you plan and take advantage of tax-advantaged account.

What are the best ways to build wealth?

It is essential to create an environment that allows you to succeed. You don’t want to have the responsibility of going out and finding the money. If you don't take care, you'll waste your time trying to find ways to make money rather than creating wealth.

You also want to avoid getting into debt. It is tempting to borrow, but you must repay your debts as soon as possible.

You're setting yourself up to fail if you don't have enough money for your daily living expenses. And when you fail, there won't be anything left over to save for retirement.

Therefore, it is essential that you are able to afford enough money to live comfortably before you start accumulating money.

How old should I be to start wealth management

Wealth Management should be started when you are young enough that you can enjoy the fruits of it, but not too young that reality is lost.

The sooner you begin investing, the more money you'll make over the course of your life.

If you're planning on having children, you might also consider starting your journey early.

Waiting until later in life can lead to you living off savings for the remainder of your life.

How to Beat Inflation With Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution, when people began saving money, inflation has been a problem. The government manages inflation by increasing interest rates and printing more currency (inflation). But, inflation can be stopped without you having to save any money.

For instance, foreign markets are a good option as they don't suffer from inflation. There are other options, such as investing in precious metals. Since their prices rise even when the dollar falls, silver and gold are "real" investments. Investors concerned about inflation can also consider precious metals.

What is estate plan?

Estate planning is the process of creating an estate plan that includes documents like wills, trusts and powers of attorney. These documents are necessary to protect your assets and ensure you can continue to manage them after you die.

Statistics

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

How To Invest Your Savings To Make Money

You can earn returns on your capital by investing your savings into various types of investments like stock market, mutual fund, bonds, bonds, real property, commodities, gold and other assets. This is known as investing. It is important that you understand that investing doesn't guarantee a profit. However, it can increase your chances of earning profits. There are many different ways to invest savings. You can invest your savings in stocks, mutual funds, gold, commodities, real estate, bonds, stock, ETFs, or other exchange traded funds. These methods will be discussed below.

Stock Market

Because you can buy shares of companies that offer products or services similar to your own, the stock market is a popular way to invest your savings. Additionally, stocks offer diversification and protection against financial loss. If the price of oil falls dramatically, your shares can be sold and bought shares in another company.

Mutual Fund

A mutual funds is a fund that combines money from several individuals or institutions and invests in securities. They are professionally managed pools with equity, debt or hybrid securities. The mutual fund's investment goals are usually determined by its board of directors.

Gold

It has been proven to hold its value for long periods of time and can be used as a safety haven in times of economic uncertainty. It can also be used in certain countries as a currency. Due to investors looking for protection from inflation, gold prices have increased significantly in recent years. The supply and demand factors determine how much gold is worth.

Real Estate

Real estate refers to land and buildings. Real estate is land and buildings that you own. You may rent out part of your house for additional income. You may use the home as collateral for loans. The home can also be used as collateral for loans. Before purchasing any type or property, however, you should consider the following: size, condition, age, and location.

Commodity

Commodities are raw materials, such as metals, grain, and agricultural goods. These items are more valuable than ever so commodity-related investments are a good idea. Investors who want capital to capitalize on this trend will need to be able to analyse charts and graphs, spot trends, and decide the best entry point for their portfolios.

Bonds

BONDS ARE LOANS between governments and corporations. A bond is a loan agreement where the principal will be repaid by one party in return for interest payments. Bond prices move up when interest rates go down and vice versa. A bond is purchased by an investor to generate interest while the borrower waits to repay the principal.

Stocks

STOCKS INVOLVE SHARES OF OWNERSHIP IN A CORPORATION. A share represents a fractional ownership of a business. You are a shareholder if you own 100 shares in XYZ Corp. and have the right to vote on any matters affecting the company. When the company is profitable, you will also be entitled to dividends. Dividends are cash distributions paid out to shareholders.

ETFs

An Exchange Traded Fund (ETF), is a security which tracks an index of stocks or bonds, currencies, commodities or other asset classes. ETFs trade in the same way as stocks on public exchanges as traditional mutual funds. The iShares Core S&P 500 eTF (NYSEARCA – SPY), for example, tracks the performance Standard & Poor’s 500 Index. This means that if you bought shares of SPY, your portfolio would automatically reflect the performance of the S&P 500.

Venture Capital

Venture capital refers to private funding venture capitalists offer entrepreneurs to help start new businesses. Venture capitalists lend financing to startups that have little or no revenue, and who are also at high risk for failure. Venture capitalists typically invest in companies at early stages, like those that are just starting out.