A Financial Advisers (FA) is a professional who provides financial services to clients. An industry body that regulates financial advice requires that a financial advisor has specific training and be registered with the body. In order to give impartial advice to clients, they must follow a code for ethics and practice. There are three types: fiduciary, fee-only and commission-only.

Fiduciaries work with financial advisers that charge a fee.

A fee-only financial advisor can offer many advantages. These advisors can provide fiduciary advice but not all clients have the means to pay. However, fee-only financial advisers are an excellent choice for clients who want to achieve their financial goals with guidance from an expert. Continue reading to learn more about fee only advisers. Below are a few facts you need to know about these professionals.

A fee-only financial advisor may charge a flat rate for their services. Financial institutions are prohibited from giving commissions to fee-only advisors. This prevents conflict of interest and establishes a fiduciary relationship. Financial advisers who charge a fee only will disclose any fees to clients. In this way, fee-only financial planners are more likely offer customized advice to clients.

Financial advisors who charge a fee can only sell mutual fund products

To confuse investors, "feebased financial advisor" was introduced. However, this type of advisor is the most common type of financial advisor. Fee-based advisors can work for UBS and Merrill Lynch as well as Morgan Stanley, JP Morgan, Morgan Stanley, Merrill Lynch, and Morgan Stanley. Brokerage commissions may be earned by others selling mutual funds and other securities. Insurance agents and other fee-based advisors can also be paid. They make a commission on the sale of mutual funds or insurance policies.

Many people prefer financial advice that is free to them. But, fee-only advisors are often more appealing than those who charge a fee. While most fee-based financial advisors receive commissions for sales, the latter may be a conflict of interest. The commissions can lead advisors to recommend products that are not appropriate for your needs. You need to be informed when selecting an advisor.

Fiduciaries are not available to financial advisors that only charge commissions

Can commission-only financial professionals be considered fiduciaries? If they adhere to the fiduciary standard they may be. However, this standard can often be subjective. While a commission-only advisor might sell products they believe are best for clients' portfolios, they don't have to disclose any conflicts of interest. A commission-only financial advisor is not required to disclose conflicts.

Fee-only advisers are, however, required to act in clients' best interests. Financial advisers who charge a fee must disclose any potential conflicts of interests and offer advice only based on the unique financial circumstances and financial goals of their clients. Some people are more emotionally sensitive to money. It is possible that they make poor investment choices due to the recent stock markets crash, or are concerned about their loved ones' financial future. This is why commission-only financial advisers do not serve as fiduciaries.

FAQ

What are the Benefits of a Financial Planner?

Having a financial plan means you have a road map to follow. You won't be left guessing as to what's going to happen next.

It will give you peace of heart knowing you have a plan that can be used in the event of an unexpected circumstance.

Your financial plan will also help you manage your debt better. If you have a good understanding of your debts, you'll know exactly how much you owe and what you can afford to pay back.

A financial plan can also protect your assets against being taken.

What is wealth management?

Wealth Management can be described as the management of money for individuals or families. It includes all aspects of financial planning, including investing, insurance, tax, estate planning, retirement planning and protection, liquidity, and risk management.

What is risk management in investment administration?

Risk management is the act of assessing and mitigating potential losses. It involves the identification, measurement, monitoring, and control of risks.

Investment strategies must include risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

These are the core elements of risk management

-

Identifying the risk factors

-

Monitoring and measuring risk

-

How to control the risk

-

How to manage risk

Who Should Use A Wealth Manager?

Everyone who wishes to increase their wealth must understand the risks.

People who are new to investing might not understand the concept of risk. Bad investment decisions could lead to them losing money.

This is true even for those who are already wealthy. They might feel like they've got enough money to last them a lifetime. But this isn't always true, and they could lose everything if they aren't careful.

Each person's personal circumstances should be considered when deciding whether to hire a wealth management company.

How much do I have to pay for Retirement Planning

No. You don't need to pay for any of this. We offer free consultations to show you the possibilities and you can then decide if you want to continue our services.

How to Beat Inflation by Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution, when people began saving money, inflation has been a problem. The government regulates inflation by increasing interest rates, printing new currency (inflation). There are other ways to combat inflation, but you don't have to spend your money.

You can, for example, invest in foreign markets that don't have as much inflation. An alternative option is to make investments in precious metals. Because their prices rise despite the dollar falling, gold and silver are examples of real investments. Investors who are concerned by inflation should also consider precious metals.

Statistics

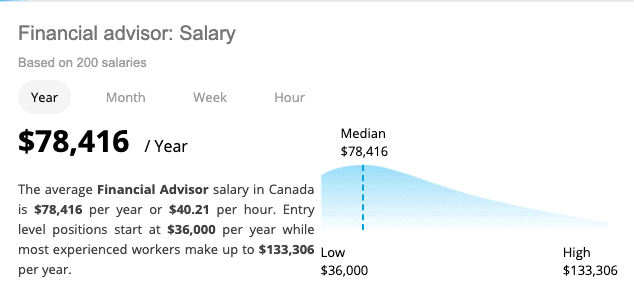

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to Beat the Inflation by Investing

Inflation can be a major factor in your financial security. Inflation has been increasing steadily for the past few decades, it has been shown. The rate of increase varies across countries. India, for example is seeing an inflation rate much higher than China. This means that even though you may have saved money, your future income might not be sufficient. You risk losing opportunities to earn additional income if you don't invest often. How do you deal with inflation?

Stocks are one way to beat inflation. Stocks have a good rate of return (ROI). You can also use these funds to buy gold, silver, real estate, or any other asset that promises a better ROI. You should be careful before you start investing in stocks.

First of all, choose the stock market that you want to join. Do you prefer small-cap firms or large-cap corporations? Decide accordingly. Next, determine the nature or the market that you're entering. Are you looking at growth stocks or value stocks? Decide accordingly. Finally, be aware of the risks associated each type of stock exchange you choose. There are many stock options on today's stock markets. Some stocks can be risky and others more secure. Take your time.

Get expert advice if you're planning on investing in the stock market. They will tell you whether you are making the right choice. Diversifying your portfolio is a must if you want to invest on the stock markets. Diversifying will increase your chances of making a decent profit. You risk losing everything if only one company invests in your portfolio.

A financial advisor can be consulted if you still require assistance. These experts will help you navigate the process of investing. They will help you choose the best stock to invest in. You will be able to get help from them regarding when to exit, depending on what your goals are.